1 April 2021

Strata Managers as Fiduciaries

A paper by Gary Bugden OAM. April 2021. Preliminaries 1. Coverage In this paper I will consider: what we mean by a “fiduciary”; how to determine if a fiduciary relationship…

An article by Michael Kleinschmidt, Partner in our Queensland office.

Published: 18th May 2023

—-

One of my favourite (though admittedly now very ‘un-PC’) cinematic moments, is the bar scene from A Beautiful Mind (2001), starring Russell Crowe as the brilliant mathematician, John Nash.

Here is a reminder…. A Beautiful Mind – Bar Scene John Nash’s Equilibrium Game Theory.

In essence, university bar denizen Nash, with pals, deliberate how to solve the ‘problem’ of which of them should approach the beautiful young lady who has just arrived at the bar with 4 of her friends. If the boys compete, then in first instance they will ‘block’ each other. Having ‘failed’ if they then try to strike up conversation with one of the 4 girlfriends, they will each likely be rebuffed. After all, no-one with self-respect likes being second choice.

In a flash of insight, Nash realises that departing from Adam Smith’s dicta of individual competition, could bring about a superior result. That is, if all the boys ignore the beautiful young lady, and instead each approach one of the 4 friends, in first instance, then they are each much more likely to end up with a date for the night.

As Nash puts it, ‘the best result will come from everyone in the group, doing what’s best for themselves and the group.’

On 16 February 2023 Attorney General and Minister for Justice, Minister for Women and Minister for the prevention of Domestic and Family Violence, the Honourable Shannon Fentiman, issued a much-anticipated media release. Shortly, ageing, or rundown community titles schemes in Queensland would be easier to redevelop, unlocking vital land for the building of new homes or residential units. How? By permitting 75% of lot owners to pass a vote that the community titles scheme be terminated, because it is more financially viable to do so, rather than to maintain or remediate the scheme.

A draft of the amending Bill is no doubt in preparation, which takes into account submissions made by various peak stakeholder’s groups over more than a decade. For all of the collective wisdom, exceptional intelligence and genuine goodwill contained in those submissions and (fingers crossed) reflected in the Bill, the new model will fail if it does not change the current Nash Equilibrium.

At present, as the Attorney General’s press release says, there are only two ways to terminate a community titles scheme. First, if all lot owners agree; that is, 100% support. Second, if on application to the District Court, the Court determines that it is just and equitable for the scheme to be terminated.

After 23 years in the strata game, I can tell you that termination under either method is as rare as rocking horse poop. For the Court to make the order, the scheme must be so far gone, that the only humane thing to do is turn off the life support. That is, the debts to be paid, or the cost of the work to be done, is worth more than the scheme land itself, or very close to it.

Likewise, 100% agreement usually involves something which we all see a lot less of these days; bags and bags of cash. Developers can, and have, successfully negotiated buy outs, from the super simple (‘I’ll give you $x, you give me your unit’) through to the complex (‘I’ll purchase your lot subject to all other lots selling to me, satisfactory DA and construction finance, you get a share of site value pre-DA but in any event no less than $y, which you can trade in whole or in part with cash back to me, for a new unit in the new building’).

Ask any developer however and they will tell you that one thing is universally true – the bags of cash handed over get bigger towards the end of the buyout process. In other words, ‘hold outs’ tend to end up better off, compared to those lot owners who sell up early.

In summary, individual competition tends to achieve better results for the individual, at present.

The reason for this is the Nash Equilibrium which currently exists in the ‘game’ that is redevelopment of community titles schemes in Queensland. As simply (and I hope accurately) as I can put it, currently for lot owners in Queensland, absent their scheme being so run down that the Court will terminate it, the best strategy to maximise a lot owner’s return, is to hold out, for so long as any other single lot owner can prevent an en bloc sale.

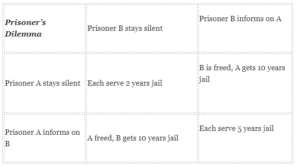

This Nash Equilibrium is very similar to something a lot of us encountered at High School seniors or leadership camp, the ‘Prisoners Dilemma’. You know, the group exercise where you are broken into two groups of prisoners (the co-accused), and each group has to decide whether to stay silent about the crime they committed together, or to inform the cops on their fellow prisoner. The pay offs and rewards differ based on each of the two prisoner’s choices.

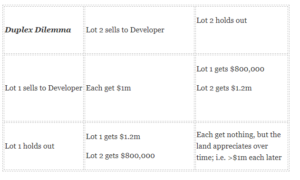

Compare that to this simple ‘problem’ of whether 2 neighbours in an old duplex on a large block in the middle of the Brisbane suburbs sell out to a Developer who has approached them both:

In each case ‘holding out’ means waiting to sell to the Developer, until after the other neighbour has sold to the Developer.

While cooperating delivers a reasonable result, it is still sub-optimal on an individual basis, and there is no incentive to change strategy, for so long as holding out provides a greater return than selling up to a Developer. The ‘Duplex Dilemma’ holds true for 2, 6 or 20 lots; size does not change the outcome.

Terminating a community titles scheme is not the end of the road for redevelopment of the scheme land, it’s just the beginning. On termination the lot owners become co-owners of all of the land that used to be the community titles scheme, as tenants in common in shares pro rata their interest schedule lot entitlements. If there are 8 lots and common property, and each lot is worth the same as each other lot and the ISLE reflect this, then all 8 lot owners will be recorded as registered owners of the new ‘parent’ parcel of land, having a 1/8th share each.

This may seem like a significant change, however while the co-owners can sell their individual ‘share’ to whoever they like, they cannot force each other lot owner to sell their shares to a given person, such as a Developer. To resolve a deadlock, any one owner can apply to the Supreme Court for the appointment of a Statutory Trustee for sale, whose job it then is to effect a sale, typically by auction or tender. With leave of the Court, co-owners can bid for the property or try to negotiate a purchase of all of the property.

While an adept Statutory Trustee could seek powers from the Court sufficient to effect a sale which maximises the return for the co-owners, the (rightly) conservative nature of the Court would place limits on this. For example, partially ‘de-risking’ the property by allowing for sale (by tender or auction) subject to the Buyer obtaining a satisfactory (re)development approval within a reasonable time limit, may well be permitted by the Court. Such a sales process would increase the sale price of the land, with only minimal risk in the form of lost time and some legal expenses, incurred by the Statutory Trustee.

Adding more conditions, such as the Buyer obtaining a certain number of ‘off the plan’ sales of units to be built on the redeveloped land, and construction finance to build the unit block, would likely be a bridge too far; despite the additional sale price that should be able to be achieved by the Statutory Trustee.

Harking back to our ‘Duplex Dilemma’ above, the proceeds of a sale by a Statutory Trustee, are almost guaranteed to be less to each lot owner, than the proceeds from a voluntary, co-operative sale to a Developer. That is so, even if the Statutory Trustee can offer ‘subject to DA’ sale terms as described above.

Why? Because of the costs of the Statutory Trustee sale (including applying to the Supreme Court to have the Trustee appointed), the timing of the sale not being at the lot owner’s choice (i.e. at the right part of the property cycle), and if the scheme termination is contested, the costs of the scheme termination process.

Which brings us back to how well drafted amendments to the Body Corporate and Community Management Act 1997 to facilitate voluntary, voted scheme termination of community titles schemes by 75% of the lot owners, may well unlock some of the thousands of older, small community titles schemes in Queensland for redevelopment.

If we trust in the brilliance of John Nash, all the Palaszczuk Government needs to do with these crucial amendments, is (a) leave the rest of the scheme termination and redevelopment pathway as it currently is (that is, less financially attractive than a co-operative sale to a developer) and (b) ensure that ‘holdouts’ are not rewarded.

—-

Michael Kleinschmidt LLB LLM GDURP FACSL

Partner, Bugden Allen Graham Lawyers – Email: michael.kleinschmidt@bagl.com.au

Disclaimer: Nothing in this article is intended to be legal advice. You should seek legal advice tailored to your property’s specific circumstances. The information in this article and on our web site are of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavour to provide accurate and timely information, we do not guarantee that the information in this article is accurate at the date it is received or that it will continue to be accurate in the future.